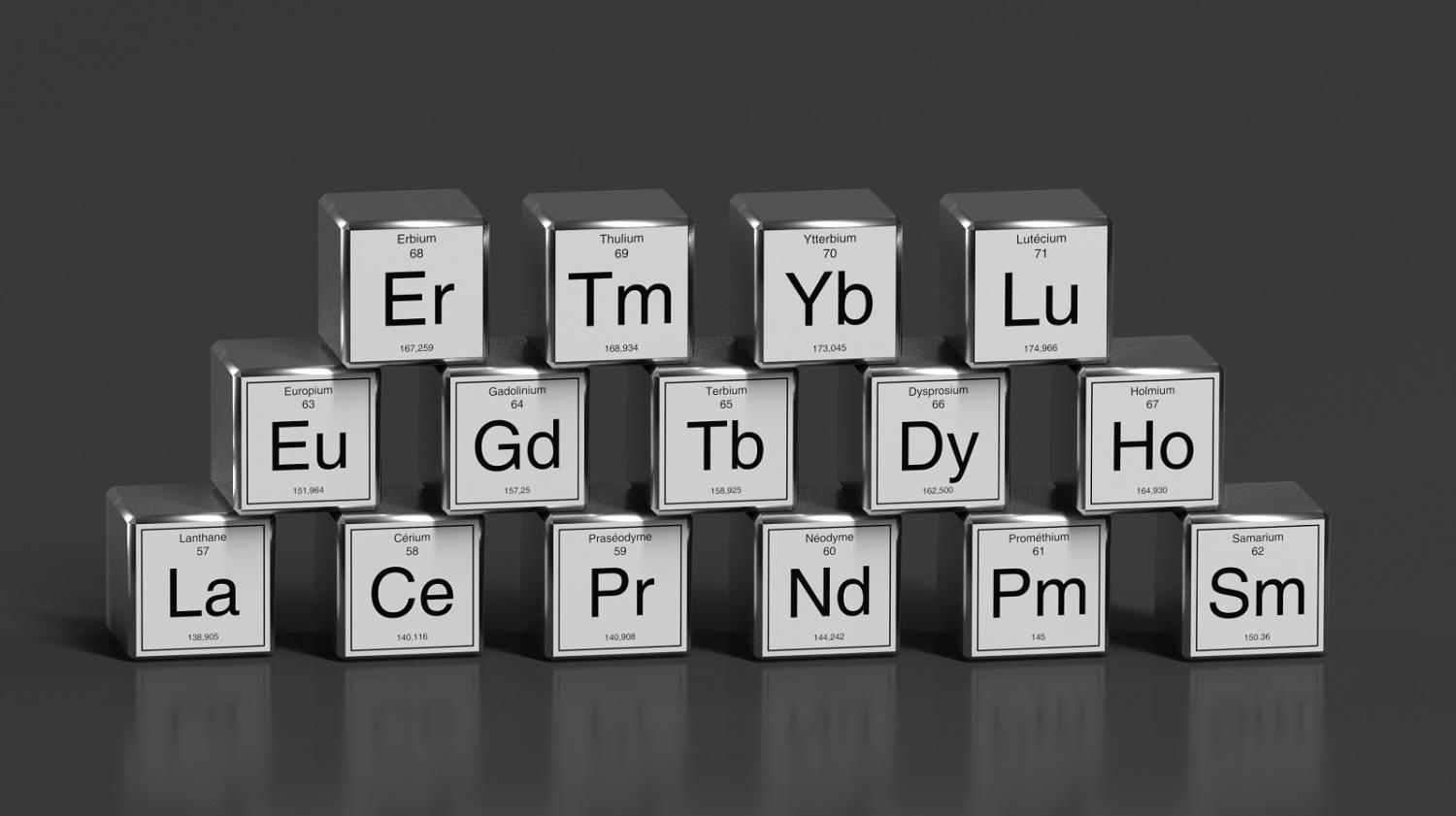

A recent analysis by the Lowy Institute suggests that China’s dominance in the rare earths industry is not solely due to its control over global supply chains, but also stems from long-term strategic planning, innovation, and state-backed industrial policy.

The article, published on May 26, 2025, argues that while China produces over 70 percent of the world’s rare earth elements, its real advantage lies in its ability to move up the value chain, refining raw materials into high-tech components used in everything from electric vehicles to advanced weapons systems.

Strategic Policy and Investment

The report highlights China’s decades-long investment in rare earths research and development, noting that state subsidies, export policies, and support for downstream industries have allowed it to dominate both the extraction and processing stages.

It also points out that China’s integration of rare earths into its broader technological and industrial goals, such as the “Made in China 2025” initiative, has given it a competitive edge over Western economies, which have often focused only on raw material access.

Western Response Lagging

According to the analysis, Western countries have underestimated the complexity of the rare earths market, particularly in processing and magnet manufacturing. While the U.S., Australia, and others have recently invested in mining projects, the report warns that without parallel investments in refining and manufacturing capacity, they may remain dependent on Chinese exports.

The author stresses that simply increasing mining output will not be enough to ensure supply chain security.

Recommendations

The article recommends that countries aiming to compete with China in the rare earth sector should:

- Invest in research, processing, and advanced materials manufacturing

- Develop regional supply chains and international partnerships

- Support policy frameworks that promote both economic and strategic resilience

Broader Implications

The piece concludes that China’s rare earth advantage reflects a broader model of strategic state capitalism, and that competing effectively will require more than just market responses. It calls on policymakers to approach the rare earths challenge with a long-term, whole-of-government strategy.

The article adds to ongoing discussions among global policymakers concerned about supply chain vulnerabilities and geopolitical risks tied to critical minerals.

Source; Lowy Institute