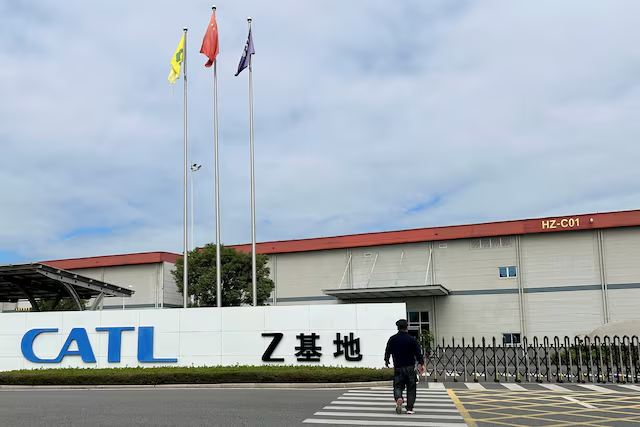

Contemporary Amperex Technology Co. Limited (CATL), a leading Chinese electric vehicle battery manufacturer, plans to raise at least HK$31.01 billion ($3.99 billion) through a Hong Kong Stock Exchange listing, making it the largest global IPO of 2025 so far. The company is offering 117.9 million shares at a maximum price of HK$263 each, with the potential to raise up to $5.3 billion through additional share options. The offering has already attracted over 20 cornerstone investors, including Sinopec and the Kuwait Investment Authority, committing approximately $2.62 billion.

The funds raised will primarily finance CATL’s new battery factory in Hungary, aimed at supplying European automakers such as BMW, Stellantis, and Volkswagen. The first phase of the €2.7 billion project is set to begin this year, with expansion plans to follow. Despite being listed by the U.S. Defense Department over alleged ties to the Chinese military, CATL states this designation does not significantly impact its operations. U.S. onshore investors are excluded from the offering.

Shares are expected to begin trading on May 20, with pricing set between May 13–16. The deal surpasses JX Advanced Metal’s $3 billion Tokyo IPO, marking a notable event amid ongoing U.S.-China trade tensions. Reuters

Source: Reuters