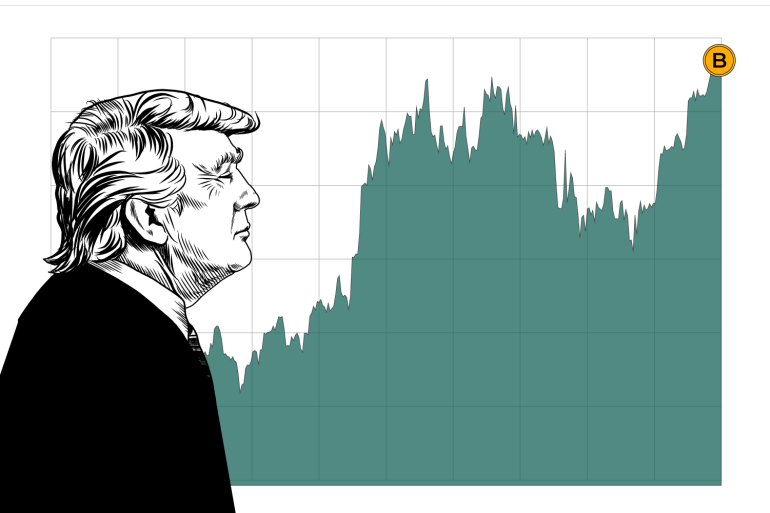

Since Donald Trump assumed office in January 2025 for his second term, Bitcoin has experienced a notable rise in value, driven by investor confidence, shifting U.S. policies, and global economic uncertainty. According to data tracked by crypto exchanges and market analysts, the digital currency has surged approximately 42% since Inauguration Day, positioning itself once again as a major financial safe haven amid global volatility.

Political Shifts and Market Optimism

Trump’s return to the White House brought renewed focus on deregulation and tax reforms that have historically resonated with crypto advocates. Investors reacted positively to early indications that the administration would not pursue stringent crypto regulations, as some expected from a Democratic government.

In the weeks following his inauguration, Bitcoin climbed from around $43,000 to over $61,000 by mid-May. Analysts say that the Republican-led administration’s pro-business rhetoric and emphasis on “financial freedom” contributed to the rally.

Policy Signals and Crypto-Friendly Moves

Trump has not released an official cryptocurrency policy, but several key appointees in the Treasury and SEC have made statements signaling openness to digital assets. One top advisor even referred to Bitcoin as “digital gold,” further fueling speculation that the White House may adopt a lenient stance toward crypto innovation.

This perceived policy shift comes as the Biden-era executive orders on crypto regulation are quietly rolled back or revised. As a result, many in the crypto industry feel emboldened to expand operations and launch new products within the U.S.

Global Factors Driving Momentum

While U.S. political developments have been crucial, global market dynamics have also played a role in Bitcoin’s recent performance. A weakening Chinese economy, ongoing conflicts in Europe and the Middle East, and rising inflation fears have all pushed investors toward non-traditional assets like cryptocurrency.

Bitcoin has benefited from safe-haven flows, similar to gold, as central banks signal potential rate cuts and fiat currencies face pressure.

Institutional Participation Rising Again

Institutional investors, which had scaled back crypto exposure during the 2022-2023 slump, are gradually re-entering the market. Major hedge funds and asset managers have increased their holdings, contributing to higher volumes and renewed price momentum.

The relisting of several spot Bitcoin ETFs and announcements from payment platforms like PayPal and Stripe to expand crypto support have also helped bolster sentiment.

Risks and Volatility Remain

Despite the bullish trend, experts caution that Bitcoin’s performance remains susceptible to volatility. Any sharp policy turn by the Trump administration—especially regarding taxation or financial regulation—could reverse the gains.

Additionally, geopolitical tensions or macroeconomic shocks could trigger abrupt corrections, especially in a market still recovering from past crypto crashes.

Conclusion

Bitcoin’s resurgence under Donald Trump’s second term highlights how political leadership can influence digital asset markets. While the surge reflects a combination of favorable policy signals, global instability, and renewed investor confidence, the cryptocurrency remains a volatile asset subject to swift market shifts. For now, Bitcoin is enjoying a bullish wave, but long-term sustainability will depend on regulatory clarity, technological evolution, and global economic trends.

Source; Al Jazeera