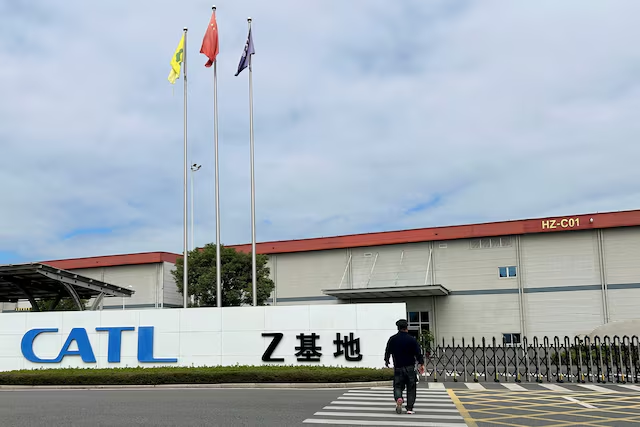

Chinese battery manufacturer Contemporary Amperex Technology Co. Limited (CATL) is set to raise at least HK$31.01 billion (approximately US$3.99 billion) through a Hong Kong stock listing, marking the city’s largest new share sale in 2025. The company plans to offer 117.9 million shares at a maximum price of HK$263 each, with the potential to increase proceeds to $5.3 billion through additional share options. Over $2.62 billion worth of shares have already been subscribed by more than 20 cornerstone investors, including Sinopec and the Kuwait Investment Authority. Institutional investors will receive 109.1 million shares, while 8.8 million shares will be offered to retail investors. CATL’s shares are scheduled to begin trading on May 20, 2025.

U.S. onshore investors are barred from participating due to CATL being listed by the U.S. Defense Department as having ties to China’s military, a designation the company disputes. Despite ongoing U.S.-China trade tensions and high tariffs, CATL maintains that its limited exposure to the North American market and alternative strategies, such as licensing battery technology to firms like Ford and Tesla, help mitigate risks.

The offering follows final investor briefings and strong early interest, with approximately $2.6 billion already secured from cornerstone investors such as the Kuwait Investment Authority and Sinopec, each committing $500 million, and Hillhouse Investment contributing $200 million. Despite geopolitical tensions and CATL’s inclusion on a U.S. Defense Department list alleging military ties—which the company denies—investor demand appears robust. The relatively narrow discount indicates strong market confidence compared to previous deals like Midea Group’s 20% discount last year. The bookbuilding process, which runs through Wednesday, has reportedly received orders that would cover the offering multiple times. The listing is scheduled for May 20 and is expected to be Hong Kong’s largest since Midea Group’s $4.6 billion IPO. CATL stated that recent tariffs by the U.S. will have minimal impact due to its limited U.S. market exposure.

Source: Reuters